Learn more about innovativecho trading.

Ready-Made Infrastructure Instead of Expensive Systems

Most hedge funds handle enormous volumes of market data, which necessitates costly infrastructure such as powerful data warehouses and external databases. Innovativecho provides an integrated infrastructure within our platform, allowing real-time access to hundreds of thousands of financial instruments, eliminating the need for complex data systems.

This ready-made infrastructure not only reduces maintenance costs but also speeds up data analysis and improves investment decision-making. By utilizing our integrated platform, hedge funds can shift their focus from maintaining costly infrastructure to strategic asset management, portfolio growth, and achieving financial goals. Our system ensures that every operational component is accessible from one centralized platform, thus reducing complexities associated with managing multiple systems and decreasing reliance on third-party solutions.

Furthermore, the platform is highly scalable, meaning it can grow alongside your fund’s increasing needs. This scalability ensures you’re not only reducing costs today but also setting a strong foundation for future growth without the need for significant re-investments into new infrastructure.

Powerful Data Analysis Without Excessive Costs

Specialized software for advanced data analysis and modeling can be another significant expense. Innovativecho simplifies these tasks by offering powerful built-in analytical tools and support for popular programming languages such as Python, providing a flexible and cost-effective solution for hedge funds needing to process and analyze vast amounts of information efficiently.

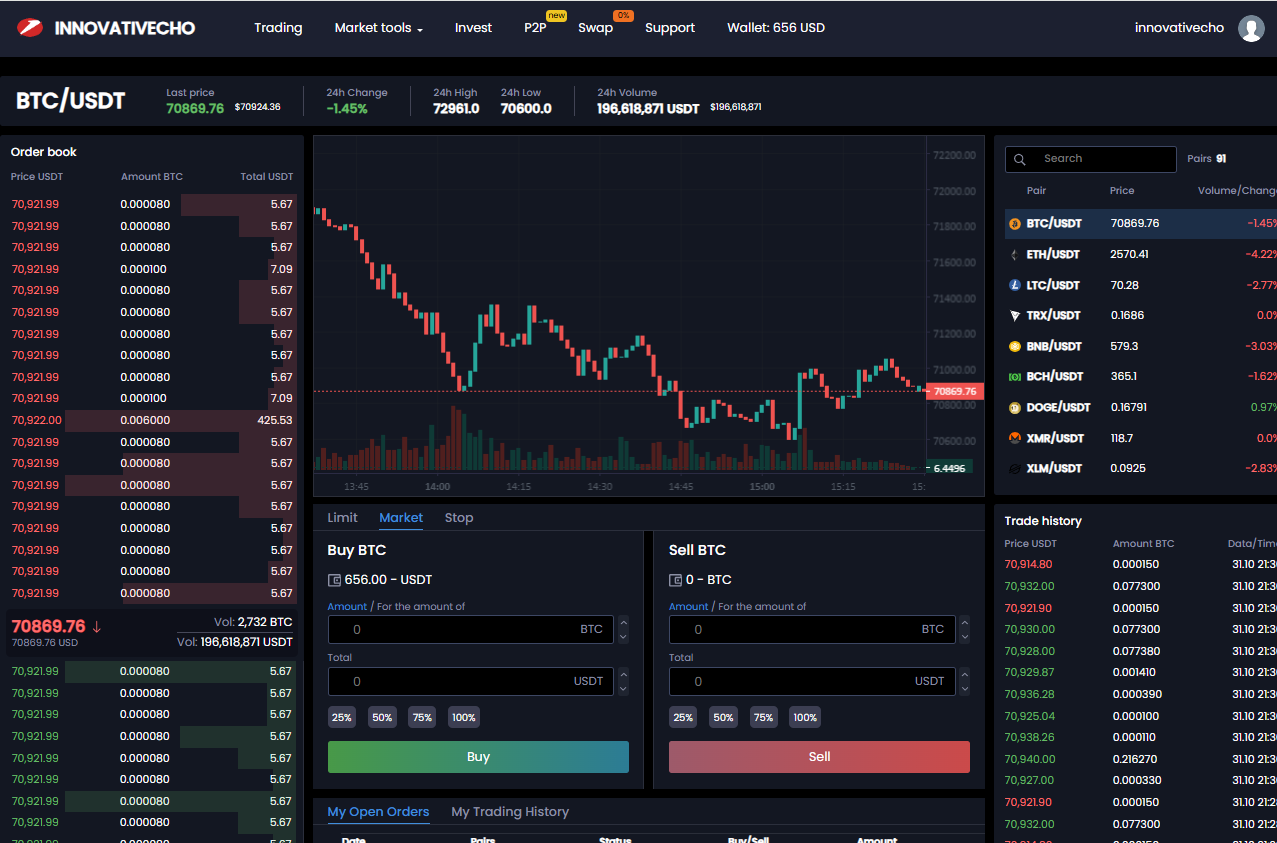

Our platform also includes extensive algorithmic trading capabilities, enabling users to create, customize, and test trading algorithms with ease. We provide a live price tracking system, allowing users to stay updated on market conditions. The live tracking feature is particularly useful for funds that need to make quick decisions based on real-time market data, ensuring that every opportunity is seized and risks are minimized. Additionally, our automated algorithmic trading feature ensures rapid and accurate trading decisions, all managed through an intuitive interface. These tools allow funds to save on costs while boosting the speed and accuracy of trading workflows.

Our platform also provides comprehensive tools for fundamental analysis, giving hedge funds access to financial news and data that impacts market prices. By combining technical and fundamental analysis, hedge funds can execute well-informed trading strategies that maximize returns.

Effective Fund Management at Lower Costs

Innovativecho provides a unique set of features for managing hedge funds and ETFs. Investors can buy fund shares directly from the platform, whether on mobile or desktop, without the need for additional third-party infrastructure. This streamlined system reduces administrative overhead and makes capital-raising efforts more efficient, allowing direct interactions between investors and the fund.

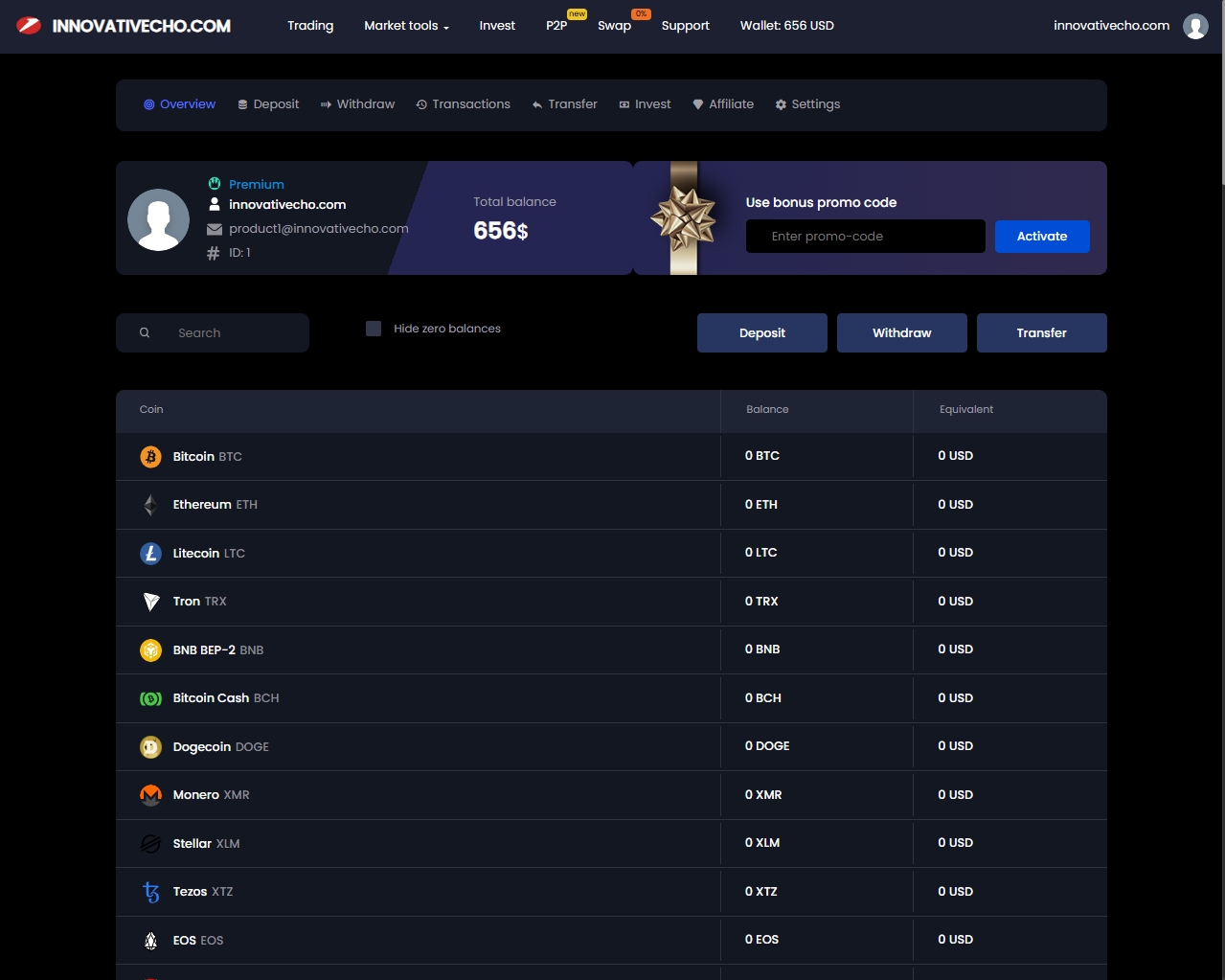

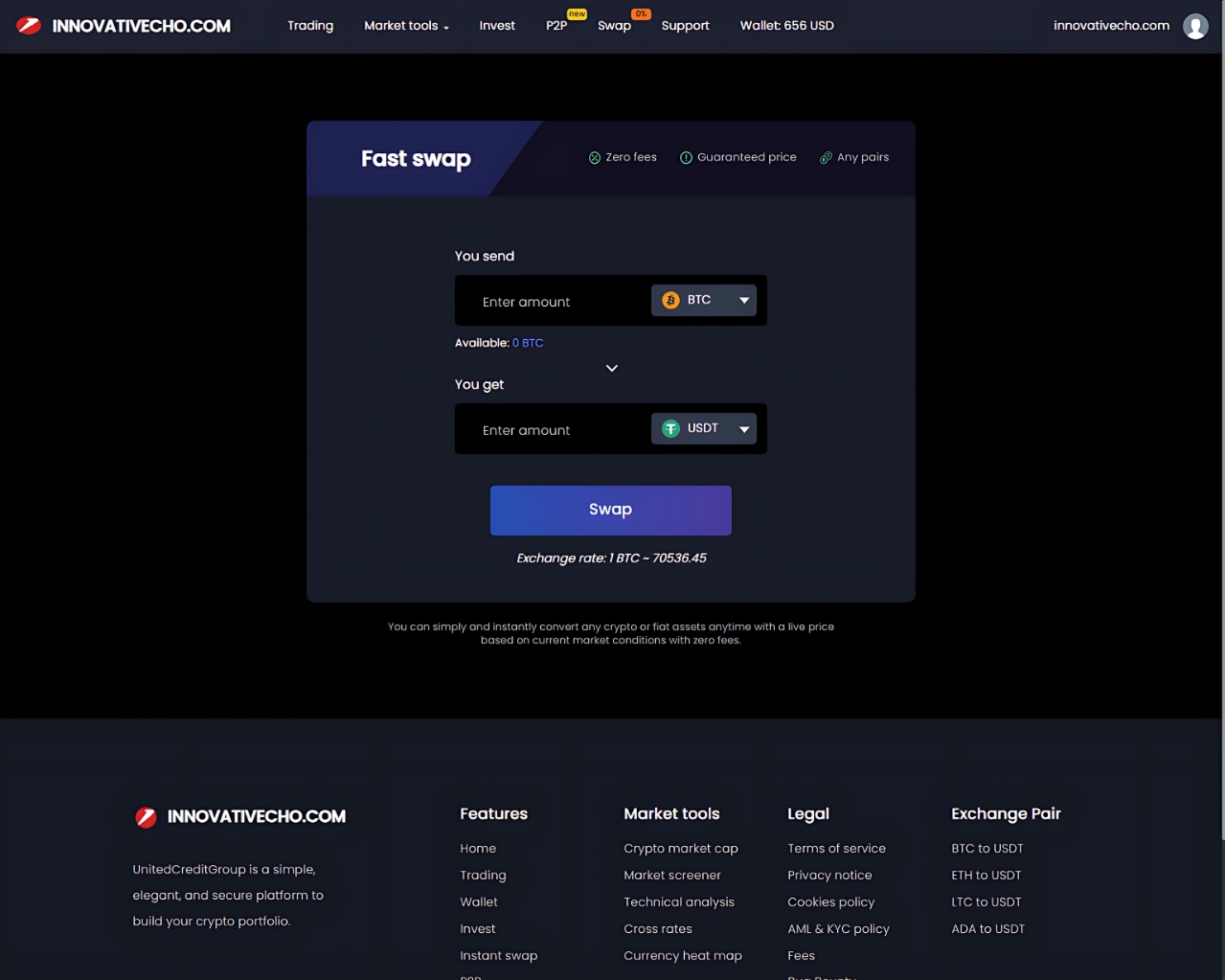

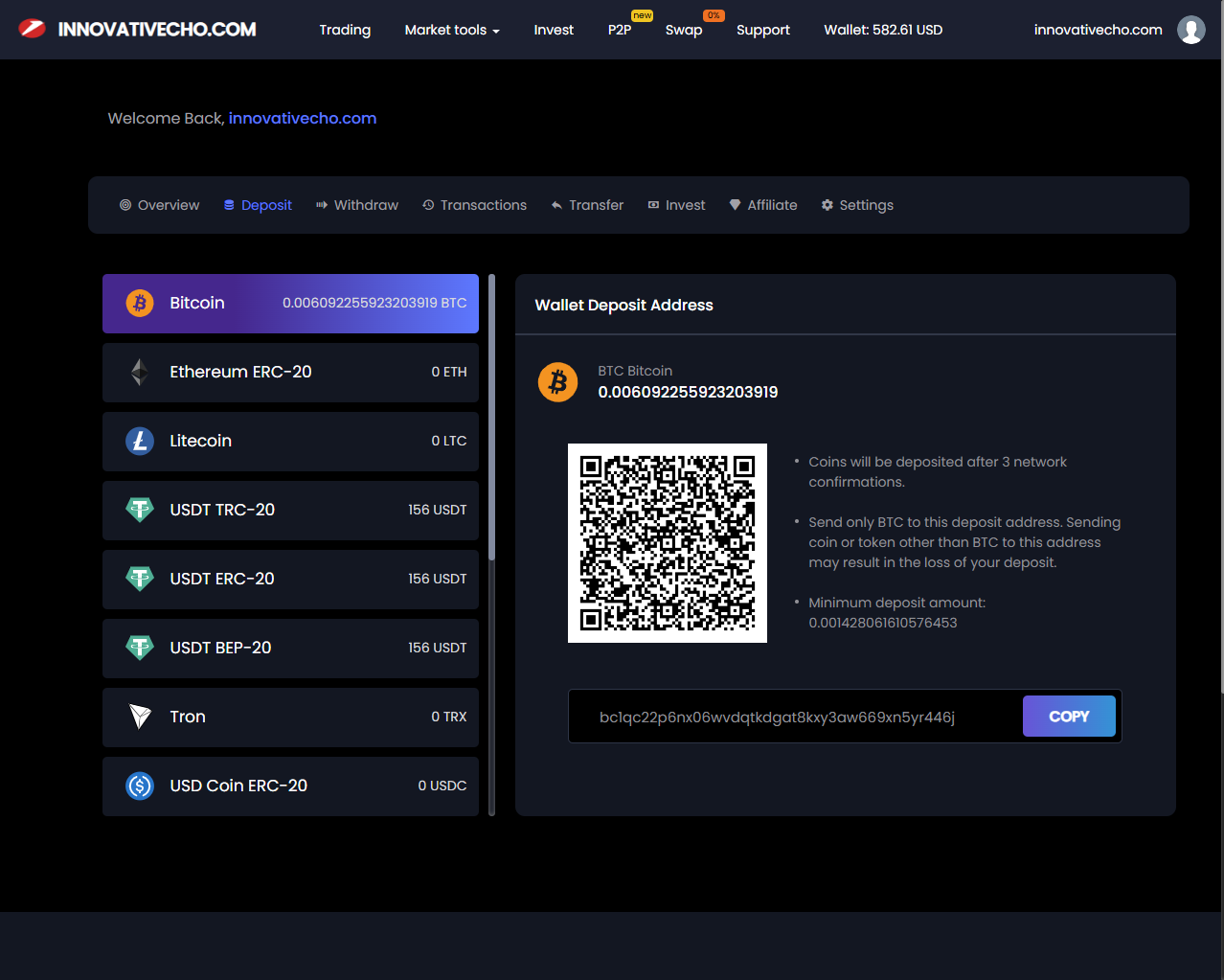

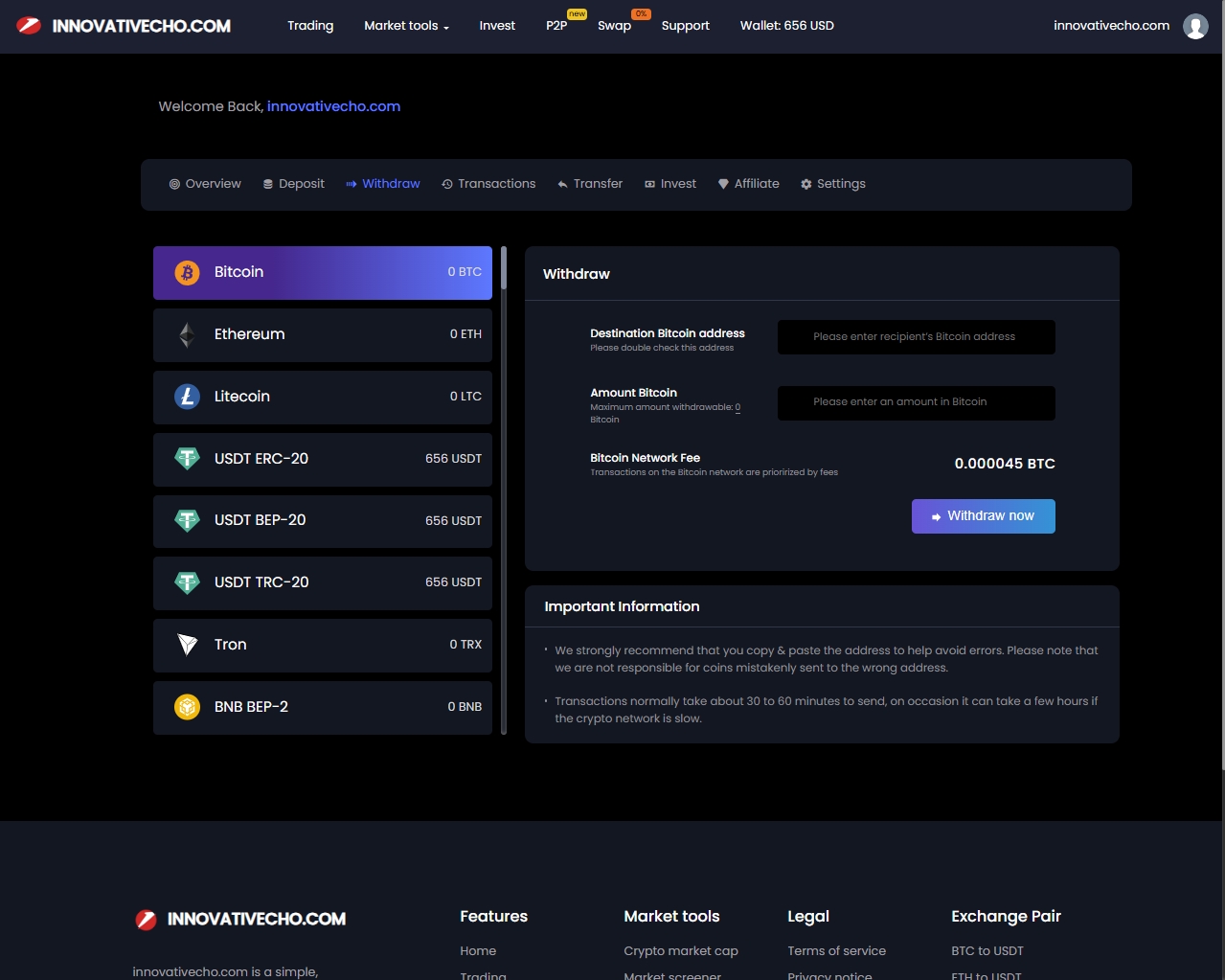

Additionally, our secure wallet asset system ensures that all assets are protected and easily accessible. The staking and investment options allow hedge funds to diversify their portfolio and generate returns efficiently. Staking allows investors to earn passive income on their holdings, while diversified investment options enable portfolio expansion into different asset classes, all from a single, integrated platform.

Our fund management tools also include customizable reporting features that provide insights into portfolio performance, cash flow, and investor engagement. These insights help hedge funds make data-driven decisions that align with their strategic goals. Administrators can effortlessly generate reports that satisfy both internal requirements and regulatory compliance standards.

Risk Mitigation and Business Automation

By automating routine operations, Innovativecho eliminates inefficient manual processes, minimizes human error, and reduces related costs. You can set individual access levels for employees and investors, monitor performance, generate detailed reports, and configure payouts based on commissions, payment methods, or other conditions. The powerful admin panel offers full oversight and customization capabilities, allowing complete control over fund activities. Additionally, the partner/worker panel ensures that tasks are assigned and managed effectively.

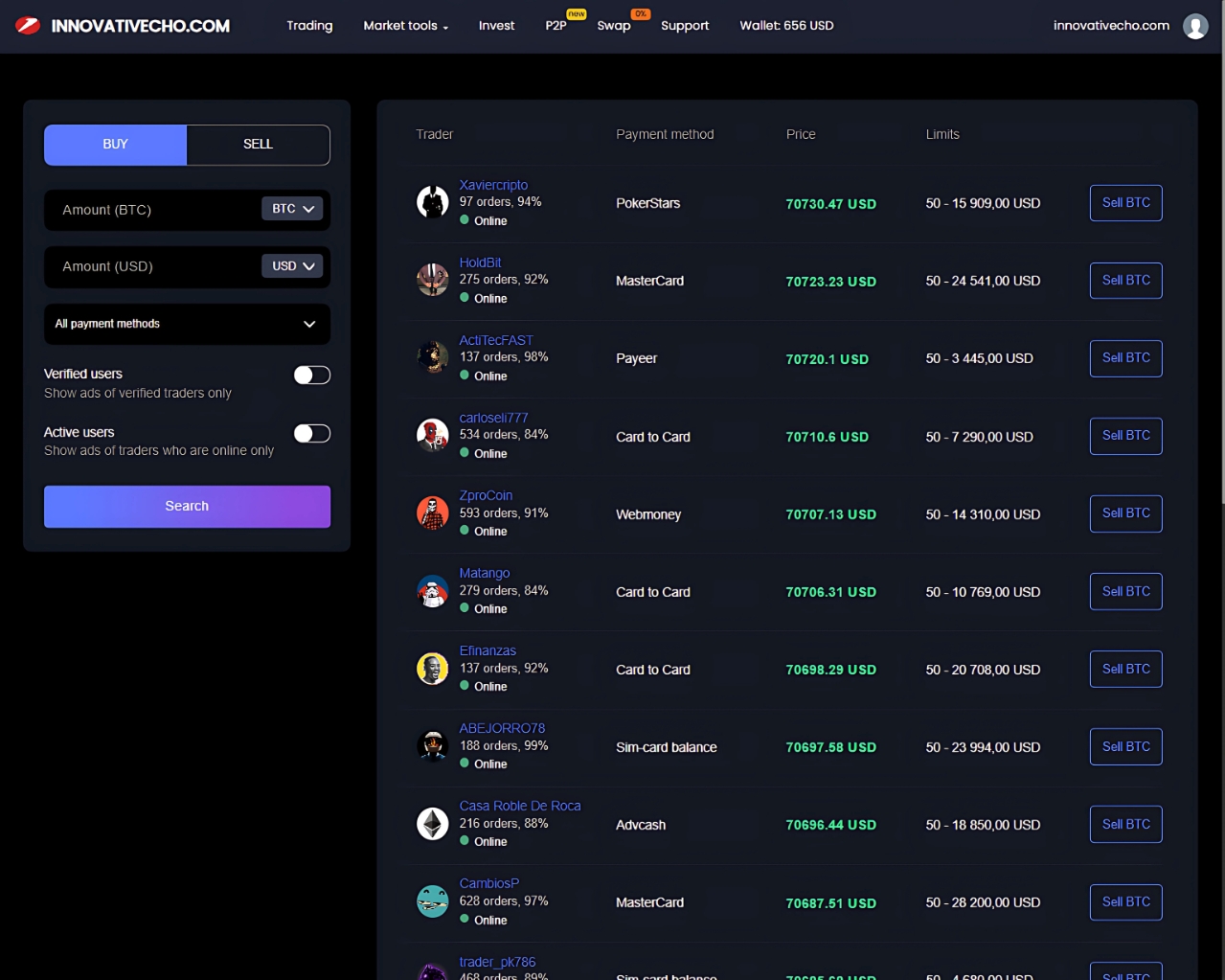

Our P2P trading system allows funds to trade directly with other users, providing flexibility and liquidity while keeping costs low. The two-step verification (2FA) feature enhances security for both investors and administrators, adding an additional layer of protection. Additionally, we have built-in KYC (Know Your Customer) processes, allowing funds to verify user identities seamlessly while remaining compliant with regulations.

With business automation, hedge funds can reduce the need for manual reconciliation, auditing, and data entry tasks. Innovativecho’s automation services handle everything from trade execution to post-trade settlement, freeing up your team to focus on value-generating activities.

Advanced Features for Optimized Hedge Fund Management

Live Price Tracking and Market Insights:

Hedge funds require up-to-date market data to make informed decisions. Innovativecho provides real-time live price tracking of major global financial instruments, ensuring that traders have the information they need at their fingertips.

Instant Fund Transfers and Liquidity Management

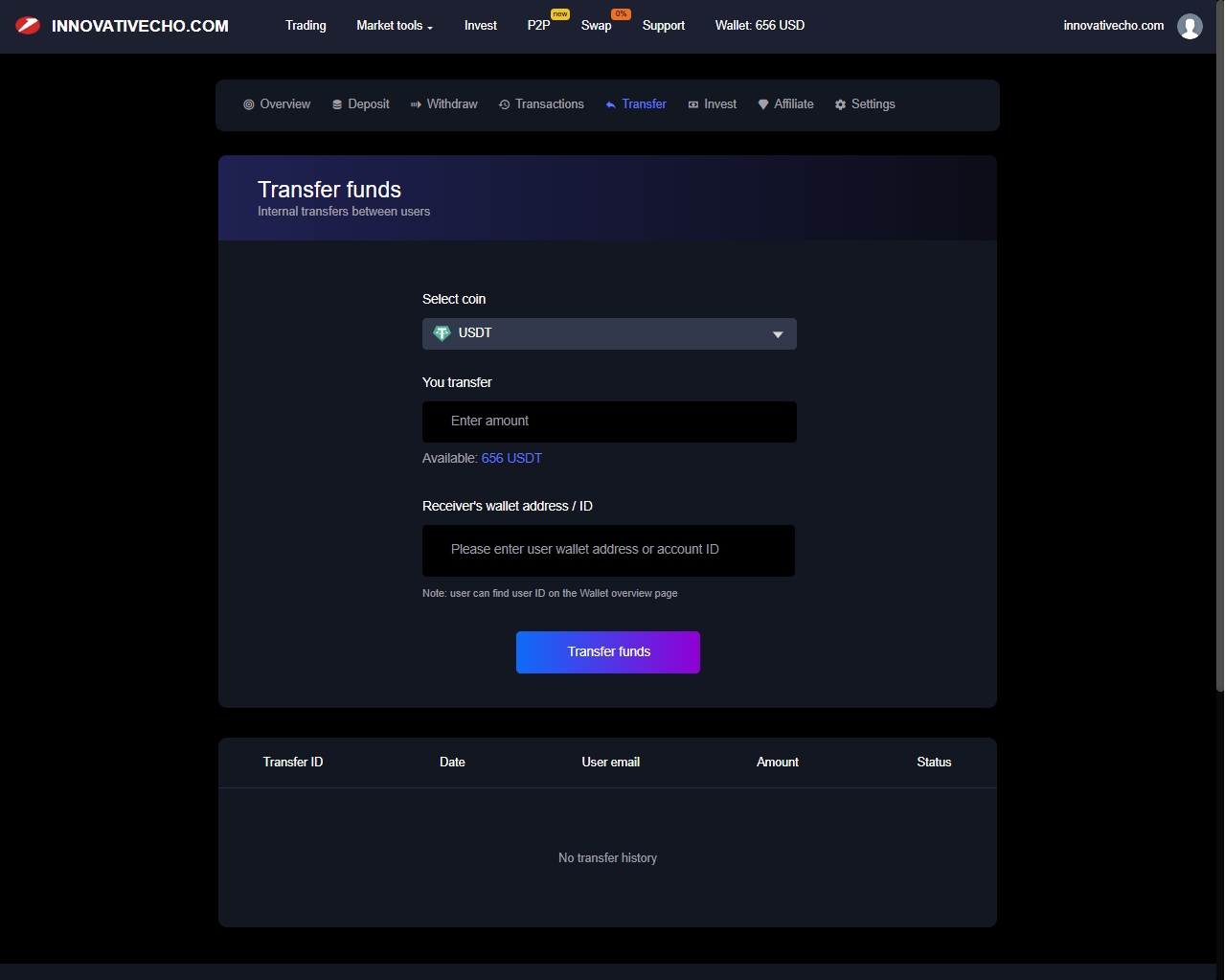

Our instant fund transfer system enables seamless movement of funds across accounts, improving liquidity management and ensuring traders are always ready to take advantage of market opportunities. Administrators can also customize fund transfer settings to align with internal policies and regulatory requirements.

Algorithmic Trading and Automated Execution

Create, customize, and deploy trading algorithms to maximize profits and minimize risks. Our automated execution ensures trades are made promptly without human intervention, taking advantage of favorable market conditions instantly.

Customizable Admin and Worker Panels

Innovativecho offers a powerful admin panel that gives administrators full control over the platform, including setting permissions, managing users, monitoring activity, and generating reports. The worker panel allows partners to efficiently manage assigned tasks and oversee key processes within the fund’s operations.

Secure Wallet Asset System and Investment Options:

Our platform includes an integrated wallet asset system that keeps funds safe and easily accessible. The staking options allow funds to invest in a variety of assets and generate passive income, further enhancing fund profitability.

P2P Trading Capabilities:

Innovativecho’s P2P trading system allows direct trading between users. This feature provides funds with additional liquidity options, allowing them to diversify trading strategies and mitigate counterparty risk.

KYC Compliance and Security Features

Built-in KYC systems ensure that only verified users have access to trading and investment options. Two-step verification (2FA) provides an additional security layer, keeping both investor and fund data secure from unauthorized access.

Reporting and Analytics

The platform comes equipped with sophisticated reporting tools that give administrators insights into fund performance, cash flow, and investor engagement. These tools are invaluable for making informed decisions and ensuring compliance with regulations.

Investment Diversification:

Hedge funds can access staking options to earn returns on held assets. Diversification is made easy through a wide range of asset classes available for investment—all within the same platform.

Integrated Customer Support and Automation

Our platform includes live customer support as well as automated support options to handle routine queries, ensuring that both administrators and investors receive timely assistance. Business automation covers routine tasks such as trade settlement, reconciliation, and reporting, minimizing errors and optimizing operational efficiency.

Key Advantages of Innovativecho for Hedge Funds

Infrastructure Savings: Eliminate the need for costly data warehouses and other external systems, reducing both initial and ongoing costs.

Enhanced Analytics: Built-in analytical tools and Python integration simplify data analysis and trading strategy development, enabling better decision-making.

Fund and ETF Management: Allow direct investor interaction with funds through the platform, reducing operational expenses and enhancing capital-raising capabilities.

Process Automation: Automate routine tasks to reduce costs, minimize errors, and improve operational efficiency, allowing staff to focus on strategic activities.

Live Price Tracking: Stay updated with real-time market prices across major financial instruments, enabling timely and profitable trading decisions.

Instant Fund Transfers: Enable fast and seamless movement of funds for improved liquidity management, ensuring funds are always available when needed.

Secure Wallet Asset System: Protect and manage assets securely through our platform’s integrated wallet system.

Staking and Investment Options: Diversify investments and earn passive income using our integrated staking features, enhancing overall portfolio performance.

P2P Trading Capabilities: Facilitate direct user-to-user trading with enhanced liquidity options and reduced counterparty risks.

Two-Step Verification (2FA): Add an extra layer of security to ensure safe transactions and protect sensitive data.

KYC Compliance: Built-in KYC systems ensure compliance with regulations while verifying the identity of investors and traders.

Customizable Admin and Partner Panels: Admin and partner panels provide comprehensive management tools, offering granular control over fund activities, permissions, and reporting.

Innovativecho for Hedge Funds is a comprehensive solution that significantly reduces infrastructure and software costs, automates critical processes, and simplifies overall company management. Use our platform to make your hedge fund more efficient, focus on your strategic goals, enhance investor relationships, and reduce the costs and complexities associated with managing modern hedge fund operations.